Stilt Can assist if you are Protected by DACA or even in the U.S. into the a charge

Thinking of moving the You.S. would be a difficult task for most people. Immigrants usually face pressures that have building earnings, providing funds and you may doing a different lifetime during the another country. Performing brand new social networking sites and you can trying to find financial freedom will take time and work.

One of the largest pressures gets a bank account or accepted getting funds, especially in place of a working credit history, however it doesn’t have to be. Financial institutions aren’t planning agree an application without an effective credit history, even after a keen immigrant visa.

Several other hurdle gets a social Cover Number (SSN), which is difficult and packed with legal and you will qualification products, papers issues or other roadblocks.

Luckily for us, a number of high solutions are around for assist You.S. immigrants create their funds, bring finance and construct credit. Fintech companies like Stilt will help when you’re protected by Deferred Step to possess Youth Arrivals (DACA) or in the You.S. into the a visa.

Discover an account, Score that loan and construct Credit With Stilt

Stilt was an online program that give immigrants which have checking account, money, remittances and you may credit creator issues. The business works closely with people generally seen as higher dangers, eg charge proprietors, DACA holders, refugees and you may asylum candidates.

The company try oriented by Rohit Mittal and you can Priyank Singh, a couple internationally people exactly who wouldn’t get approved getting financing about U.S. at the time. Predicated on an interview having Forbes, they both cared for the challenges regarding accessing economic functions because immigrants and you may planned to carry out a pals in order to serve anybody else instead of Personal Shelter amounts otherwise credit histories.

Due to the fact undertaking the travel and beginning the business more than four years ago, Stilt keeps aided several thousand immigrants with lending products. The organization possess stored them many in the charge and you can attention. Research out-of TechCrunch indexed one Stilt simply finalized a good $a hundred billion round out of money at the beginning of 2021.

Don’t allow a credit rating Avoid Your

Rather than typical loan providers, Stilt will not rely solely on the credit score to accept an excellent application for the loan, and you may profiles don’t need an excellent co-signer. This means that, users with just minimal borrowing otherwise the immigrants continue to have monetary choice. Stilt discusses other variables instance current a position, education, stuff and you can people earlier in the day bankruptcies whenever evaluating the application.

Economic Membership Designed for Immigrants

Setup and you will subscription having Stilt usually takes throughout the five full minutes. Membership residents gets a virtual debit cards and stay able to invest, conserve and you may would their cash. It is a great way to get started on building your money and working with the tomorrow.

More importantly, Stilt cannot charges one overdraft charges, plus it has no conditions to own minimal dumps. The organization brings digital and you will actual debit notes, person-to-individual transfers, many confidentiality and you may security measures, and a simple-to-play with app to own participants.

If you’re looking to obtain financing otherwise build borrowing from the bank which have Stilt, below are a few of qualifications criteria to get going:

Really Charge Products Recognized

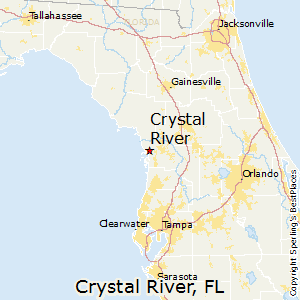

Stilt doesn’t require a personal Safety Amount otherwise environmentally friendly credit so you’re able to incorporate. Although not, you really must be individually found in the latest You.S. and just Victoria savings and installment loan have a bank account in your label of the an effective U.S. target. If you don’t have a checking account, you could unlock a free account which have Stilt very first then incorporate for a loan later on.

- CPT

- Choose

- H-1B

- O-step 1

- TN

- J-1

- L-1

Apply for financing Off Stilt

- A information

- The amount of money you want when you look at the You.S. bucks

As a result of Stilt, loan amounts are normally taken for $step 1,100 in order to $thirty five,100, which have restrict mortgage regards to up to 3 years. There are not any prepayment penalties, in order to pay off your loan early without the additional charge or attention.

Competitive Interest rates

If you utilize Stilt, unsecured loan interest rates will be less than typical financial institutions, especially for immigrants with limited credit rating. In that way, immigrants get a loan and commence building borrowing and you may a beneficial future.

Personal loan rates can vary away from six percent so you can thirty-six %, predicated on . By starting an account which have Stilt, immigrants can perhaps work into the improving their borrowing from the bank; this may at some point trigger down rates to have financing. Very, discover a free account and just have started today.

Handling Stilt would be one of the foundations you need enable it to be, build your borrowing from the bank and you can chase their “American dream” when you proceed to the latest U.S..

Stilt was designed to build loans problem-100 % free having immigrants, charge people, DACA proprietors, refugees and you will asylum individuals. Learn more right here and you can fill out an online application for the loan about comfort of one’s couch .

This new contents of this information is to have informative aim merely and you will doesn’t form financial or money pointers. It is vital to carry out your search and you will consider seeking suggestions out-of another economic elite group before making any money behavior.

Leave a Reply